How to Diversify Your Mutual Fund Portfolio (Smart Method)

Table of Contents

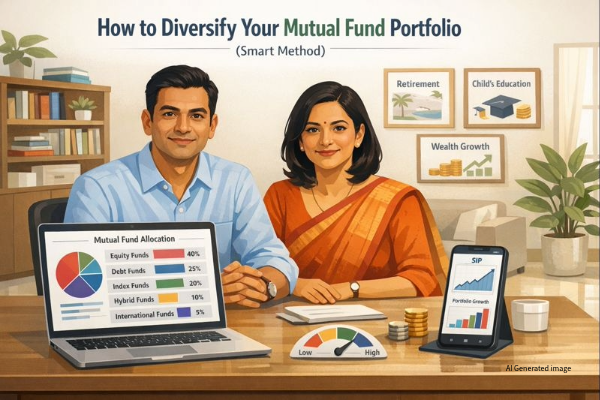

Learn the smart method how to diversify your mutual fund portfolio effectively. Discover asset allocation strategies, avoid common mistakes, and build a balanced investment portfolio for long-term wealth.

If you have been investing in mutual funds for a while, you have probably heard the word “diversification” thrown around quite a bit. It’s one of those investment principles everyone talks about, but honestly, not many people get it right.

Here’s the thing. owning five or ten different mutual funds doesn’t automatically mean your portfolio is diversified. I have seen investors holding multiple schemes that essentially invest in the same stocks, thinking they are playing it safe. That’s not diversification that’s just portfolio clutter.

Real diversification is about creating balance. It’s about making sure your investments don’t all rise and fall together. When done right, it protects your hard-earned money during market crashes while still letting you capture growth during good times.

In this guide, I’ll walk you through exactly how to build a smartly diversified mutual fund portfolio, especially if you are investing from India. No jargon overload, just practical steps you can actually use.

What Does Diversification Mean in Mutual Funds?

Let’s start with the basics. Diversification simply means spreading your investments across different types of assets that don’t move in the same direction when markets get shaky.

Think about it this way. if you invest everything in technology stocks and the tech sector crashes, your entire portfolio takes a hit. But if you have also got some exposure to banking, pharmaceuticals, debt funds, and maybe some gold, those other investments can cushion the blow.

In the mutual fund world, diversification happens across several dimensions:

Asset classes – This includes equity funds, debt funds, and gold funds. Each behaves differently under various economic conditions.

Market capitalization – Large-cap companies are stable giants, mid-caps are growing businesses, and small-caps are emerging players. They don’t all perform the same way at the same time.

Investment styles – Some funds focus on growth stocks (companies expected to grow fast), while others prefer value stocks (undervalued companies). Different styles shine in different market phases.

Geography – While most Indian investors focus on domestic funds, adding some international exposure can reduce the risk that comes with investing in just one country.

The whole point of diversification. When one part of your portfolio struggles, another part can keep things steady. That’s how you sleep better at night, even when the news is screaming about market corrections.

Why Smart Diversification Is Important

Without proper diversification, you are essentially putting yourself at the mercy of market mood swings. I have talked to investors who panicked and sold everything during the 2020 crash because their entire portfolio was in high-risk funds. That panic selling locked in their losses permanently.

Here’s what typically happens with poorly diversified portfolios:

Your investments can drop sharply during market corrections, sometimes by 40% or more. That kind of fall triggers fear and emotional decision making. You start questioning everything, reading every negative headline, and eventually, you sell at the worst possible time. The result. Inconsistent long-term performance and a lot of regret.

Now compare that to a well-diversified portfolio:

It reduces overall volatility because different assets balance each other out. Your capital stays more protected during downturns. You get better risk-adjusted returns over time. Most importantly, you are able to stay invested longer without losing sleep, which is absolutely crucial for building wealth.

Step 1: Decide Asset Allocation First

Before you even think about which mutual funds to buy, you need to figure out your asset allocation. This is the foundation of everything else.

Asset allocation means deciding how much of your money goes into equity, debt, and gold. This decision depends entirely on your risk tolerance and investment goals.

Here’s a general framework for Indian investors:

Conservative Risk Profile

- Equity: 30–40%

- Debt: 50–60%

- Gold: 5–10%

Moderate Risk Profile

- Equity: 50–60%

- Debt: 30–40%

- Gold: 5–10%

Aggressive Risk Profile

- Equity: 70–80%

- Debt: 15–25%

- Gold: 5–10%

Financial advisors and multiple studies confirm that your asset allocation impacts your returns far more than picking individual funds. You could choose the best-performing equity fund, but if your overall allocation is wrong for your risk profile, you’ll still struggle.

Step 2: Diversify Within Equity Mutual Funds

Once you know how much goes into equity, the next step is diversifying within that equity allocation. You want exposure across different market capitalizations because they behave differently.

Large-Cap Funds – Your Stability Anchor

These funds invest in well-established companies like Reliance, TCS, HDFC Bank, and Infosys. They are the slow and steady performers of your portfolio. Sure, they won’t double overnight, but they also won’t crash as hard during corrections. Allocate about 30–40% of your equity portion here.

Mid-Cap Funds – Your Growth Booster

Mid-cap companies are in their growth phase. They have more room to expand than large-caps but come with higher volatility. When markets are bullish, mid-caps can seriously outperform. During downturns, they fall harder. Keep this at 20–30% of your equity allocation.

Small-Cap Funds – Your Long-Term Wealth Builder

Small-caps are for patient investors only. These are emerging companies that can deliver exceptional returns over 7-10 years, but the journey is bumpy. Sharp ups and downs are completely normal here. Limit your exposure to 10–20% of equity, and only if you have a long investment horizon.

Flexi-Cap or Multi-Cap Funds – Built-In Diversification

These funds give flexibility to fund managers to invest across all market caps based on opportunities. They are excellent because you get automatic diversification without needing multiple schemes. One good flexi-cap fund can sometimes replace the need for separate large, mid, and small-cap funds.

Step 3: Avoid Over-Diversification

Here’s where many investors go wrong. They think more funds equal better diversification. It doesn’t work that way.

Holding 15 or 20 mutual funds doesn’t make your portfolio safer it makes it unmanageable. You end up with significant portfolio overlap, where multiple funds hold the same stocks. That’s not diversification, that’s duplication.

My guideline: 6–8 well-chosen funds across all asset classes are more than enough for most investors. Within equity alone, stick to 3–5 schemes maximum. Before adding any new fund, check its portfolio overlap with your existing holdings.

Step 4: Diversify Debt for Stability

Debt mutual funds are the shock absorbers of your portfolio. They reduce volatility and provide stability when equity markets go haywire.

Focus on safer debt fund categories:

- Liquid Funds

- Money Market Funds

- Short Duration Funds

- Corporate Bond Funds

Be cautious with Credit Risk Funds and Long Duration Funds. The latter are particularly sensitive to interest rate changes and can be volatile.

Remember, debt funds are for capital preservation, not return maximization. Don’t expect equity-like returns from them.

Step 5: Add Gold as a Hedge

Gold is that insurance policy you hope you never need but are glad you have. It historically performs well during market crashes, inflationary periods, and global economic uncertainty.

The best ways to invest in gold through mutual funds:

- Gold ETFs

- Gold Mutual Funds

- Sovereign Gold Bonds (for long-term holders)

Keep your gold allocation between 5–10% of your total portfolio. It won’t make you rich, but it’ll protect wealth when everything else is falling.

Step 6: Consider International Exposure

Adding international funds reduces your dependence on just the Indian economy. You get exposure to global companies like Apple, Microsoft, Amazon, and Google.

Common options include US equity funds and Nasdaq or global index funds. Allocate 5–10% here if you want, but it’s optional, not mandatory. Many successful investors build wealth without any international exposure.

Step 7: Diversify by Investment Style

Different investment styles work better in different market conditions. Growth stocks shine during bull markets. Value stocks tend to recover faster during market rebounds. Blended approaches provide long-term stability.

The good news. Flexi-cap funds and index funds naturally provide style balance, so you don’t need to overthink this aspect.

Step 8: Review and Rebalance Annually

Market movements will naturally throw your asset allocation off balance over time. Your equity portion might grow from 60% to 75% during a bull run, increasing your risk beyond your comfort level.

Annual rebalancing helps you book profits from outperforming assets, reinvest in underperforming ones, and maintain your original risk profile. Once a year is sufficient for most investors don’t obsess over monthly changes.

Sample Smartly Diversified Mutual Fund Portfolio

Let me show you what a practical portfolio looks like for a moderate-risk Indian investor:

- 30% Large-Cap Index Fund

- 20% Flexi-Cap Fund

- 15% Mid-Cap Fund

- 25% Short Duration Debt Fund

- 10% Gold ETF

That’s it. Five funds, clearly defined roles, properly balanced. Simple, effective, and easy to track.

Common Diversification Mistakes

Before we wrap up, let’s talk about what not to do:

Buying too many funds – More isn’t better. Focus on quality over quantity.

Ignoring asset allocation – Fund selection matters, but allocation matters more.

Overexposing to small-cap funds – They are tempting during bull markets but brutal during corrections.

Chasing past returns – Last year’s best performer is rarely next year’s winner.

Not reviewing the portfolio regularly – Set a calendar reminder for annual reviews.

Final Thoughts

Smart diversification isn’t about complexity—it’s about clarity and discipline. Your portfolio doesn’t need to top the returns chart every single year. What it needs to do is survive the bad years while steadily compounding wealth over time.

A well-diversified mutual fund portfolio is like a well-balanced diet. You won’t get dramatic results overnight, but over months and years, you’ll be healthier, stronger, and better equipped to handle whatever life throws at you.

The same principle applies to your investments. Balance beats brilliance in the long run. Consistency beats complexity every single time.

So take a fresh look at your portfolio today. Are you truly diversified, or just holding multiple funds. The difference could determine whether you achieve your financial goals or keep wondering why your investments aren’t working.

FAQs

How many mutual funds should I have in a diversified portfolio?

Is diversification the same as owning many mutual funds?

What is the best way to diversify equity mutual funds in India?

The smart way to diversify equity funds is to combine:

- Large-cap funds for stability

- Mid-cap funds for growth

- Limited exposure to small-cap funds

- Flexi-cap or index funds for balance

This approach ensures risk control while capturing long-term growth.